The Young Investor Issue 1 | Hello World 👋🏾

For investors, founders, and anyone this helps.

Hiya 👋🏾. Thanks for checking out The Young Investor, a “newsletter”, created by me Chaleb. The Young Investor is for founders in Gen Z, the LGBTQ+ community, and the BIPOC community. The Young Investor newsletter focuses on topics of diversity and inclusion in startup funding, aims to highlight voices of underrepresented founders in the startup space, and tell the chronicle of my experience as I dig through the the weeds (with the help of some friends) of startup investing. I raised close to $200K for a makerspace I started in South Florida (first of its kind) which led me to recognize the lack of diversity in not only areas like tech but also founder funding.

A few housekeeping tasks I want to get out the way:

I’m still fairly new to the startup investing scene so keep that in mind.

I have a full time job and I’m a student so keep that in mind 😛. I’ll try and be consistent though.

I hate newsletters that tell you, “HERES THE BLUEPRINT TO BECOME A BILLIONAIRE WITH JUST A LAPTOP”. This is not one of those. I will be providing some of my personal experience and things I learn along the way.

I hate long intros so let’s get to the juice. 🎉

I started this newsletter to write about a few things primarily:

My journey at 16 years old becoming a syndicate lead. (More on what a syndicate lead is in a few)

Deal flow, due diligence, networking, and also n3tw0rk1ng (not a typo 😛)

Highlighting founders in the Gen Z community and other underrepresented groups.

The startup investment world and it’s place in the Gen Z community and other underrepresented groups.

What’s In This 🧐

I don’t know about you but I like to know what’s in the thing I’m reading before I read it.

Understanding syndicate deals

Journaling and why founders should do it

Resources for new (and old) syndicate leads or those aspiring to start one

What I’m Reading 📚

You will hear me mention this person a million times. Paige Doherty is an incredible person and someone who’s been showing me the ropes as I learn the ropes of syndicate investing.

She wrote up an awesome resource on understanding syndicate deals which is linked below.

She even has something for aspiring VCs out there which I’ve also been reading.

Journaling as a Founder 📔

The startup lifestyle is not for the faint of heart. 1 in 3 founders get less than 6 hours of sleep daily. If you’re going to deprive yourself of sleep do it the smart way. Enter journaling. From investor meetings, to pitch competitions, to standup calls the day of a startup founder is one that is never dull. Having a journal to chronicle key actionable steps of your day is an important step to managing your time as effectively as possible. I use Notion for just about everything including my journaling. Don’t use it just because I mentioned it, use it if it works for you. I’ve seen people have great luck with paper based solutions like simple bullet journals. I pick my tools to be centered around me as a person and build them around my flaws and habits. Notion works great for me because it’s where I build everything like my due diligence sheets in Notion which I share with LPs+angels. (More on this in a few)

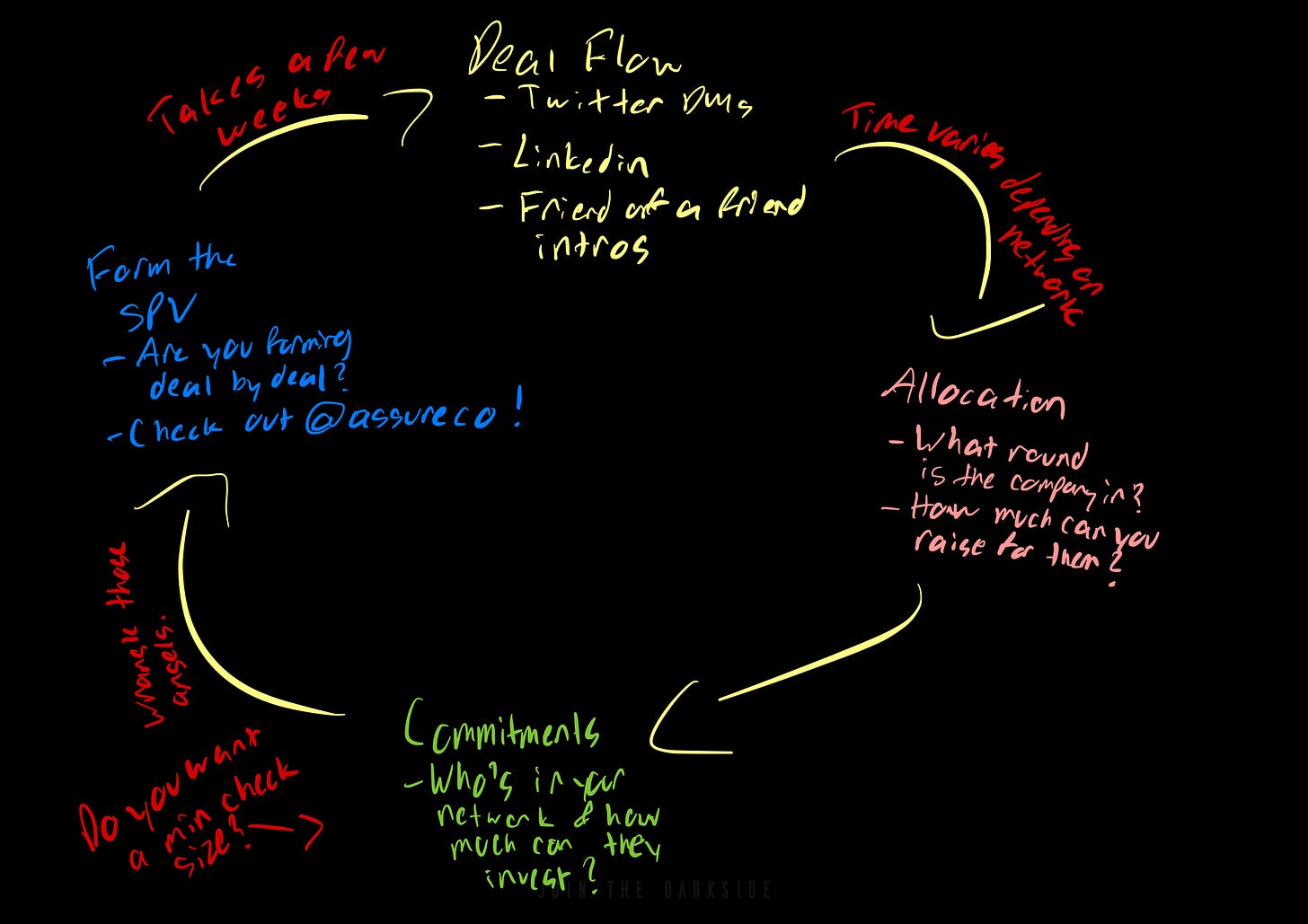

Blueprint of a Syndicate Deal

Establish Deal Flow

This can be as easy or as hard as you make it. As someone who had to raise money for a few non-profits, cold outreach is something I’ve gotten pretty decent at. Won’t go into too much detail in this one post.

Secure an allocation

Make sure you tell the founder you’re working with you’re a syndicate. It looks super disingenuous to have a net of investors behind you but pass it off as just a one person show. You don’t need to talk about certain things with them like carry but give them the details on how the deal structure wise is going to look. What I mean by that is make sure they’re clear a syndicate isn’t just Bob. It’s Bob as the face but Sarah, James, Johny, etc are doing stuff behind the scenes. Like providing capital 😂. Don’t short your investors. Some teams have minimum check sizes, so if this is the case be sure to ask what their minimum check size is for the round so you can give your LPs/angels the best info possible.

Commitments 💸

The hard stuff. If you’re just starting out and building your reputation like I am it can be hard to secure commitments right off the bat. To boost your chances having things like a due diligence sheet to share with investors (something I’ll talk more about in another issue) is an easy way to get the info in front of them without asking them to schedule a meeting. Of course it helps to meet with all your investors so definitely ask for a call once you’ve established a connection. Figure out if you want to establish a minimum check size for your syndicate depending on the size of the deal it can help to establish a minimum check size to speed up a raise.

Form the SPV 🏙

An SPV is your special purpose vehicle. This is your “syndicate”. SPVs allow early-stage VCs and angels to raise capital for early-late stage investments and special opportunities. The capital comes from their existing limited partners and relationships. Your SPV acts as the holding company for any of the interests members of your syndicate have via the deals you bring them. Instead of founders issuing stocks to 30 people they issue to one entity which actually helps founders keep their cap tables clean which they appreciate. There are a few services out there like AngelList Syndicates. However I use Assure and I love the people. They handle everything from setting up your syndicate’s bank acct, to investor onboarding, and wiring payments. Highly recommend checking them out. They charge $2,500 upfront + 1.5% of the raise. You can choose to pass this off to your investors or if you’re a baller you can front it yourself. I however am not 😂

Founders to Keep an Eye On

Amazing people making waves 🌊

Samson Larsson, Ayazona

Ayazona is on a mission to make access to food and essential items affordable for everyone especially low-income households. Since starting Ayazona, Samson’s team has secured partnerships with over 160 restaurants and 350 couriers. As a technical fellow from Code for Africa, Samson and his team are using technology to help address food insecurity in Africa.

Rachel Cash, Elroi

With privacy becoming an ever growing concern as the tech industry continues to boom, Rachel and her team at Elroi are making moves in the privacy sector by providing enterprise and consumer solutions to manage client and consumer data and ensuring its compliance with legal and best data privacy practices. Her team is filling an area where many have tried to tap before and have failed. As a data privacy attorney and having worked on Elroi for just over 3 years, she is dedicated to executing on her vision to return privacy to consumers and assist enterprise partners with ensuring data security.

Well that’s all for now y’all. Hope you enjoy 😊 Don’t forget to share with some friends and in your communities.